【 微信扫码 】

【 微信扫码 】

PPS (polyphenylene sulfide) is a kind of thermoplastic special engineering plastics with excellent comprehensive properties. It is known as the sixth largest engineering plastic variety after the five major engineering plastics of polycarbonate (PC), polyester (PET), polyoxymethylene (POM), nylon (PA) and polyphenylene ether (PPO), and it is also the "eight major". One of the aerospace materials. Its downstream industrial chain mainly includes environmental protection industry, automobile industry, textile industry and electrical and electronic industry. In 2019Q1, the average market price of PPS (R-4) was 78,000 yuan/ton, and the average market price of PPS (R-7-02) was 55,000 yuan/ton.

PPS industry chain

Data source: public information collation

PPS price trend

Data source: public information collation

At present, the gap between supply and demand of PPS continues to expand, and the import volume continues to increase. In 2017/18, the output of PPS was 291/34900 tons, a year-on-year increase of 20.25%/19.93%, and the demand was 1374/158000 tons, a year-on-year increase of 15%/15%. The domestic PPS supply is growing slowly. In 2016, China's PPS consumption accounted for 38% of the world's total. The domestic production capacity is far from meeting the domestic demand. Moreover, the innovation capability of domestic enterprises is low, and there is a gap between the product quality and types of foreign companies. It is estimated that in 2019/20, my country's PPS output will be 41,900/50,300 tons, and the demand will be 18.2/209,200 tons. In 2016, the global demand for PPS resin was 83,700 tons, and it is expected to reach 110,100 tons by 2020. In 2017, the new energy vehicle industry became the largest driving force downstream of PPS, accounting for 41%, followed by electrical and electronic and filter materials, accounting for 20% and 16% respectively.

Supply and demand of PPS over the years

Data source: public information collation

Distribution of PPS Downstream Demand in 2017

Data source: public information collation

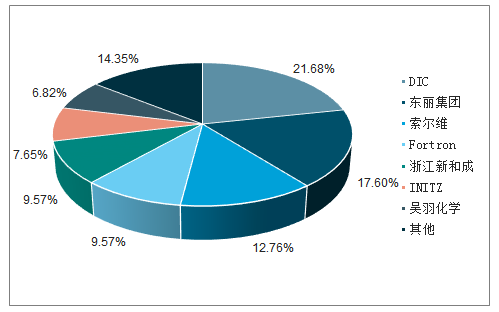

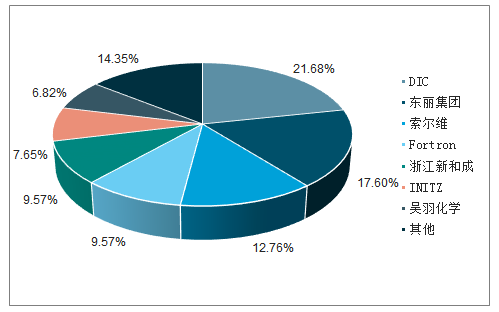

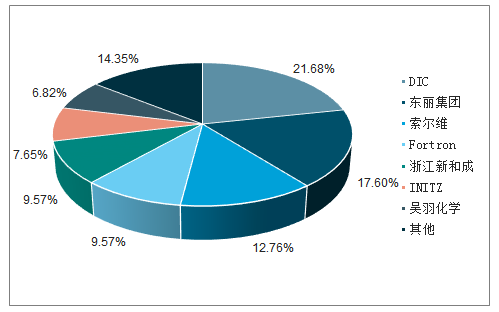

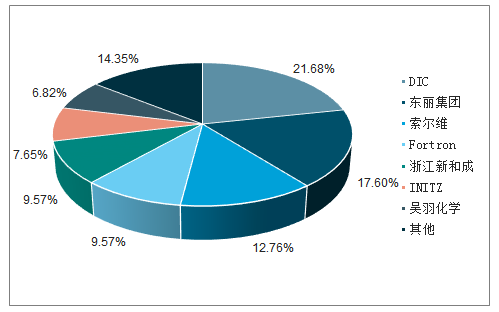

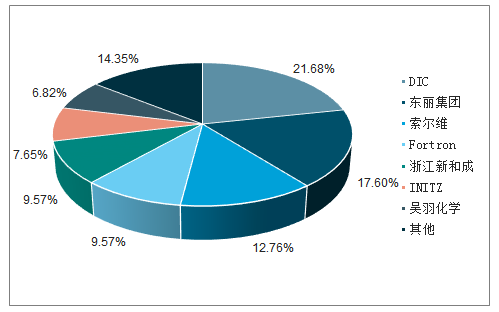

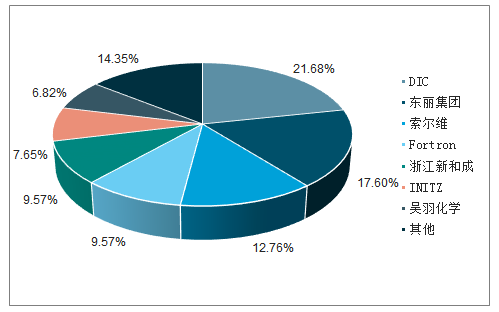

Most of the PPS production capacity is concentrated in Japan. In 2018, the global main production capacity totaled 156,800 tons, and the capacity under construction was 59,500 tons. Most of the production enterprises are concentrated in Japan, of which DIC is the world's largest PPS producer, accounting for 21.68% of the world's production capacity. The expansion of the production of PPS compounds in DIC's Komaki plant will further consolidate DIC's leading position in the world. With the addition of factories in Malaysia, Austria and Zhangjiagang, China, DIC will occupy 27%-30% of the global PPC compound market in the future.

PPS global production capacity

Data source: public information collation

2018 PPS global production capacity distribution

Data source: public information collation